This post contains affiliate links. If you make a qualifying purchase after clicking a link, we may receive a percentage of the purchase price.

Over the years, I have waxed and waned in my practice of the various strategies I’ve learned regarding saving money on groceries. When I have money, but not much time, I don’t maximize these strategies. When I have both time and money, I don’t maximize these strategies. When I have time, but not much money, I must maximize these strategies. At the moment, I find myself in the latter category, and so I am reminding myself of the things I already knew. I thought I would share these things with you, to adopt or not, if it works for you.

Why Focus on Food?

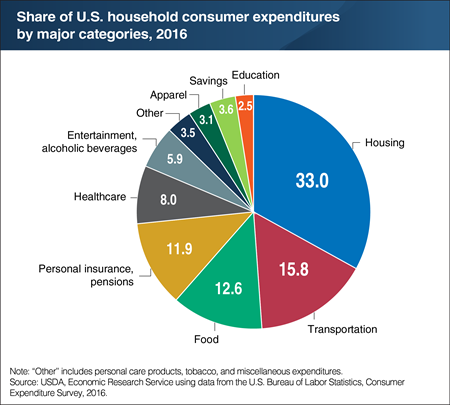

If you are looking to save money in your overall budget, victory starts in the kitchen. Food is the third largest household expenditure in the United States.

Housing and Transportation costs may be reduced, but they tend to be sunk costs. If you own a home, it will take time to sell and buy or rent a less expensive place. If you rent, the penalties incurred in breaking a lease may be more than you would pay to stay through the end of the lease. Reducing transportation costs might mean moving closer to work, buying a new vehicle, or figuring out ride sharing options. Since Housing and Transportation are sunk costs, it may take weeks or months to work out lower-cost options.

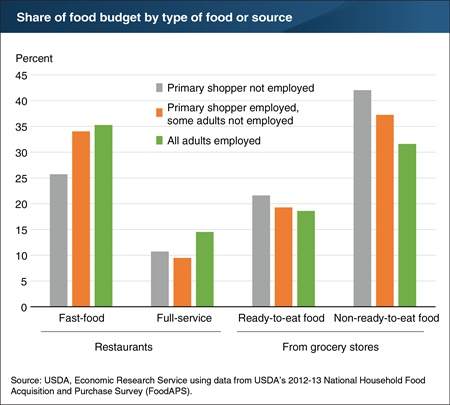

In the chart above, the amount spent on food includes both dining out and food at home (groceries), which includes purchase of both raw ingredients and prepared foods. This chart breaks the food budget down into the types of food purchased, based on the level of employment in a household.

This chart demonstrates why it makes sense to start with food if you want to reduce your budget. You have multiple options for food: eating out, purchasing prepared foods, or purchasing raw ingredients and preparing food yourself. Since food is perishable, you make a daily decision on what to eat. Therefore, the financial impact of changing your food decisions can be seen in a matter of days.

What’s coming in this series

The strategies discussed focus on grocery shopping for raw ingredients. This is almost always the least expensive way to eat. However, the overall goal is food that (1) tastes good and (2) promotes health (3) at the lowest possible cost, with an eye to the (4) time it takes to prepare food and clean-up afterwards. The least expensive option possible is not always going to meet the first two goals and is likely to increase the time spent on cooking and cleaning up.

Almost everything I know about saving money on groceries, I learned from either my mother or The Tightwad Gazette by Amy Dacyczyn (Amazon affiliate link). When I was growing up, our family did not have much money. My mother kept a strict grocery budget and usually took her children with her when she shopped. We learned many shopping lessons by osmosis!

I lived with my parents until I married my first husband, six weeks shy of my twenty-second birthday. We did not have much money either, so I was always looking for ways to save money. It was at this time that I found The Tightwad Gazette, which taught me systemization in a way that my mother had not.

The strategies I learned from my mother and from The Tightwad Gazette will help you determine the lowest cost of any food items you wish to purchase. It’s up to you to weigh the monetary costs against the taste, health, and time factors impacting your life.

Click here for Part 2: Pay Attention to Unit Pricing

Click here for Part 3: Keep a Price Book

Click here for Part 4: Shop at Multiple Stores

Click here for Part 5: Use Coupons? Not Anymore

Click here for Part 6a: Calculating the Cost of Homemade: Ingredient Costs

Click here for Part 6b: Calculating the Cost of Homemade: Recipe Costs

Click here for Part 6c: Calculating the Cost of Homemade: Where to Start with Cooking

Click here for Part 6d: Calculating the Cost of Homemade: Putting it All Together

8 Replies to “Early Lessons, Part I: The Why”

Comments are closed.